About Zerodha

India,s no 1 stock broker with cilent base of 7 Millions as on 2022. Zerodha offer,s Rs 0 brokerage stock investment in India. Just needs to pay Flat Rs 20/Trade for all intraday trades. which is why it is known as the first-ever Discount stockbroker in the financial market of India. Zerodha provides flate brokerage charges across all major stock exchanges like NSE, BSE, and MCX. They provide trading opportunities across all segments like equity, commodity, and currency trading with flat brokerage charges of just Rs 20/trade. cheapest or the flat brokerage house that made zero brokerage or commission famous in India and adding several new Demat accounts to the exchanges. like to know more about Zerodha Demat’s account and charges. ![]() visit zerodha

visit zerodha

Zerodha was formed in the city of Bangalore and operating successful business in India over 1100 coustomer support teams.and, they have spread across the country and made more than 7 millions of clients. The investors and the traders call this company with various names such as Budget broker or pay per order brokerage firm and of course discount broker. This company serves all the needs of investors whether they are investing in the equity segment or in commodities or in Currency Derivatives.

Zerodha doesn’t have any minimum brokerage and that is what made it famous across the investors. But what made it the most sought-after brokerage house is their policy that you (investor) either have to pay only INR 20 or 0.01% on each trade of any volume and price.

The volume of the trade doesn’t influence the Zerodha brokerage charges and thus if you are buying a lot of share or a single share you pay 20 as the maximum charges. They charge as the lower of 0.01% of the transaction or INR 20 for any trade and of course, if you are taking delivery, you don’t have to pay any charges.

Buy the mutual funds and that too also with the direct buy/sell provision. There is a product called Zerodha Coins which you can use to buy and sell mutual funds directly.

The brokerage structure is also very simple and anyone who is interested in trading can understand it easily.

Zerodha brokerage charges and earlier used to trade with other brokerage houses reported more than 80% savings in their brokerage costs which are huge. Most importantly, this brokerage house is completely technology-driven making thousands and lacs of trades feasible and easy to operate whether you are an intraday trader or a long-term investor, you are going to have a great time while trading on the Zerodha platform. They use software like PI which is used for desktop trading and KITE for mobile and web-based trading platforms or applications (apps). The motto of this brokerage firm is to ease the trading and investments in India with no restrictions.

Demat and trading account charges

| Sl | TYPE of ACCOUNT | FEES |

| 1 | Demat account | Rs 200 |

| 2. | Trading account | Rs 200(one time) |

| 3. | Demat+trading account | Rs 200 |

| 4 | AMC (every year) | Rs 300 |

BROKERAGE CHARGES

The Demat account opening charges are mentioned above and along with that, there will be a charge of INR 300 every year for which you maintain your Demat account which you have to pay upfront. This is the maintenance charges of the account with Zerodha and it is payable annually.

Detailed Brokerage charges:

The brokerages are divided according to trades and they are as follows –

- For taking equity delivery – INR 0. You can invest any amount for any time period without any brokerage.

- Intraday Brokerage for trading Equities – INR 20 or 0.03% of the each traded amount whichever is lower.

- Brokerage on Equity Future trading – lower of the 0.03% or INR 20 for each trade.

- Brokerage on Equity options – 0.03% or INR 20, lower of the two on per trade basis (turnover basis)

- Brokerage on Currency Futures – 0.03% or INR 20, lower of the two on per trade amount

- Brokerage on currency Options – 0.03% or INR 20 per trade whichever amount is the amount.

- Brokerage on trading commodities – 0.03% or INR 20, the lower of the two amounts on each trade basis.

Other Charges

- STT – For Equity delivery, it is 0.1% on both buying and selling of the equities and for intraday trade, it is 0.025% on the selling side. For futures, it is 0.01% on the sell side and for options, 0.05% on the premium of the sell side.

- Transaction/turnover Charges – For equity delivery on NSE it is INR 325 for each 1 crore and on BSE it is INR 1 for each trade on both side. For Intraday, the charges are same on both the exchanges. For Futures, it is INR 210 per crore on NSE and INR 1 for each trade (both side) and for options, it is INR 5300 per crore and INR 1 on both side per trade on the premium of options.

- GST – For both Intraday and Deliver on Equity and F&O it is 18% on the sum of brokerage amount and transaction charges.

- SEBI Charges – INR 15 per 1 crore for both intraday and delivery. It is same equity as well as F&O.

- Stamp Charges – It is according to the rules of the state for both equities and F&O on both delivery and intraday.

Hidden Charges:

What are the other charges which are looks hidden and required for you to know before open a demat account are as follows-

Trade n Call facility @ INR 20 per trade.

INR 50 for every position which is not squared off on the orders executed for MIS/BO/CO.

INR 50 as additional charges for courier of Physical copies of contract notes.

DP charges for equity delivery selling – INR 8 per transaction. Other charges as per NSE, statutory bodies etc.

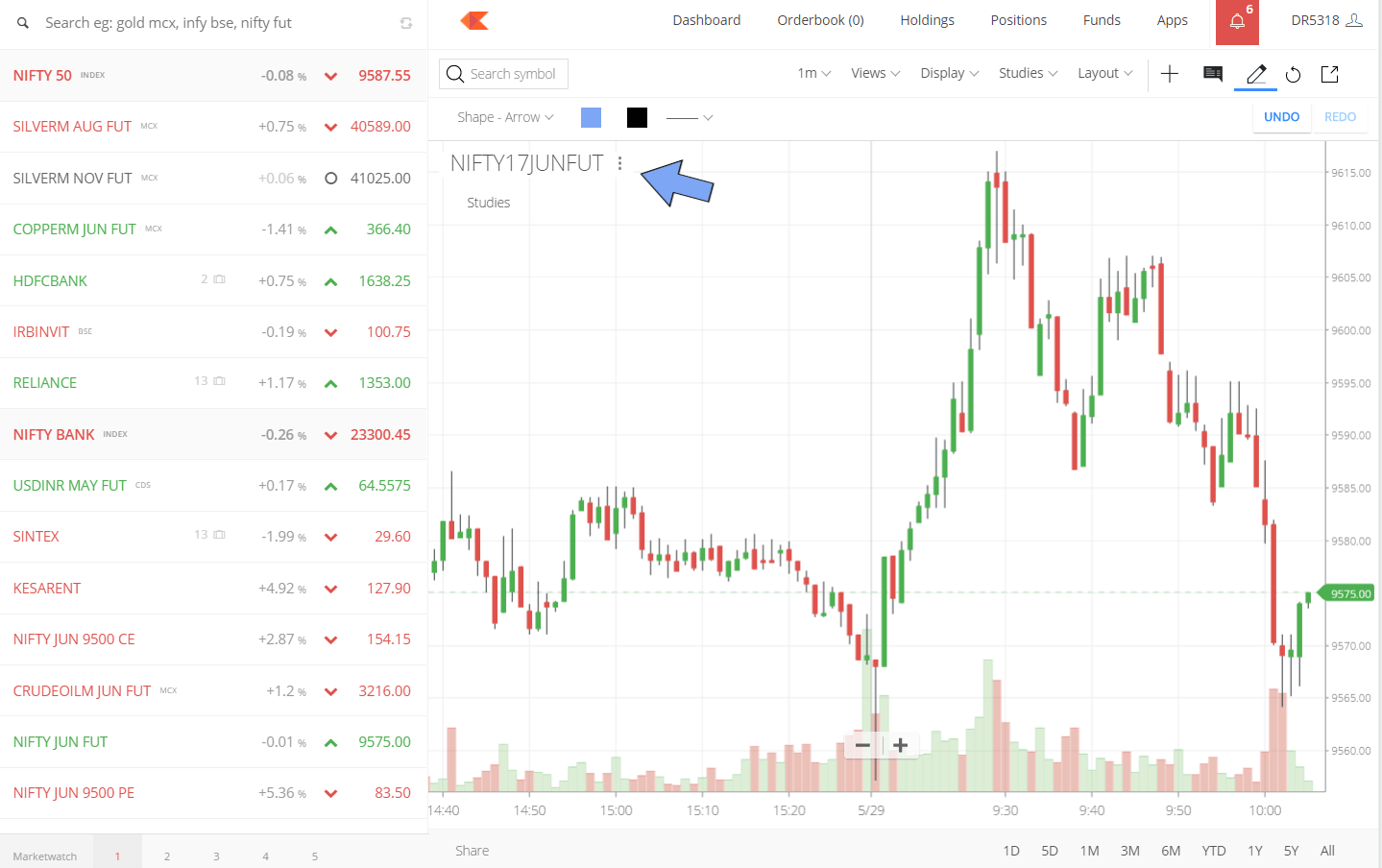

ZERODHA TRADING PLATFORM (KITE)

Frequently Asked Questions

Here are few questions about zerodha demat account openning, brokerage charges and trading apps. zerodha is no 1 stock broker of india with the highest clients base more than 7 miliouns.

How is zerodha as a stock broker for traders ?

Zerodha is no 1 stock broker of India and offering Rs 0 brokerage equity delivery, mutual funds investments. Just needs to pay Rs 20/trade for all intraday charges. we are highly recommend this stock broker for Rs 0 brokerage charges for equity delivery charges. Zerodha offer,s most advanced trading apps for easy day trading activities for investers.

How is zerodha trading platform?

Zerodha provides best trading apps like Kite and Kite web for traders. Trading web app is live treaming, better charting software, trading

How easy to open a demat and trading account with zerodha?

Zerodha provides instant account openning process online. demat and trading account can be open online and offline with the help of aadhar and Pan card.

how is charges levied by zerodha demat and trading account ?

Zerodha charges Rs 200 for demat and trading account online fees. Demat and trading fees Rs 200 can be paid online through UPI/ net banking / credit cards etc.Offline demat account can be openned through taking printing available on zerodha site.

how is much time takes zerodha demat account openning ?

Post online account opening process complete it takes 48 hrs to verify the account opening process and if any other documents by zerodha. If all documents provided online are complete. they provide id and password through email registered with zerodha.

0 Comments